What is Cryptocurrency OTC Trading?

Cryptocurrency OTC Trading

You’ve probably heard of cryptocurrency oTC trading. But what exactly is this trading method? It involves sending a bank transfer to a person who owns a cryptocurrency and sending it to someone else, who in turn sends the money to a different person who has crypto coins to sell. While this is a legitimate method of trading, it’s not publically reported or independently audited. To understand what this type of trading is, let’s take a closer look.

An OTC desk is a financial company that manages and coordinates digital asset transactions. Its advantages include price stability, speed, security, and confidentiality. However, it doesn’t always work that way. To understand how this type of trading works, let’s look at some of the things that it offers. Here are a few reasons why you should use an OTC desk for your cryptocurrency trading. They could help you avoid the mistakes made by many people who trade on these exchanges.

Fiat wires are a common way to trade digital assets, but this can be a time-consuming process. Fiat wires typically take three days or longer depending on timezone and country. Using a cryptocurrency ATM allows you to send and receive fiat instantly. In contrast, digital assets are exchanged on the blockchain and can take 12 hours or more, depending on network congestion. Additionally, you can reduce the risk of fraud by using an OTC platform.

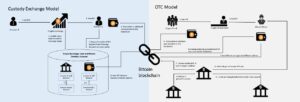

Decentralized OTC crypto exchange

Another popular type of OTC trade is the P2P model. A P2P OTC trade involves two individuals who are familiar with each other and can communicate with each other in real-time. The price of an asset is calculated on the basis of demand in the market and the company can predict its value. Once it’s determined that the two parties can make a trade, the OTC trading desk sends the amounts to their respective receivers.

What is Cryptocurrency OTC Trading?

While these advantages of cryptocurrency OTC trading are clear, it is not without controversy. In the past, large banks have been fined millions of dollars for frontrunning their clients, exposing them to trading sharks. This practice is profitable but illegal. Since the cryptocurrency space is unregulated, it’s highly likely that operators of crypto OTC trading desks are performing similar activities. The best way to solve this issue is to create a decentralized dark pool.

In October, a large number of investors bought and sold on the cryptocurrency exchanges. This increased volume led to a sustained rally in trading volumes, which rose to $289 billion in November. In addition to this, Genesis, a popular cryptocurrency OTC trading desk, recently broke a record by reaching $600 million in trading volume, attributed to new institutional players. Meanwhile, Galaxy Digital, another prominent OTC trading desk, was not present in 2017 but has seen a dramatic increase in trading volumes.

Although traditional exchanges have been targets of hacking attacks, OTC trading is a much more secure way to trade cryptocurrency. Using a trusted broker, you can avoid pitfalls such as slippage and exchange fees. Furthermore, it’s better to avoid exchanges altogether if you can. For this reason, cryptocurrency OTC trading is a better choice if you’re not sure whether or not it’s right for you.